Self-employment is liberating especially because you have so much freedom in all your decisions. However, it can get tough during tax season or when you are applying for a loan when proof of income is asked for.

Turns out, it’s not that difficult at all! Here are some tips on how to show proof of income when self employed!

How to Show Proof of Income When Self Employed

By following the tips below, you will have no trouble showing proof of income when asked for it. All it takes is a little organization and tracking!

Keep Business and Personal Separate

Instead of putting all your money into one account and using it for all business and personal related expenses, open up two accounts and use them separately. Business expenses should only come out from your business account.

Dipping into one fund can lower your deductions and blur the lines between employment and personal finance.

Update and Track Accounting Records

When being a self-employed individual, it is important to keep track of all recipes and records of business transactions. This will all be helpful for your own records because it will show income and expenses.

Use Pay Stubs

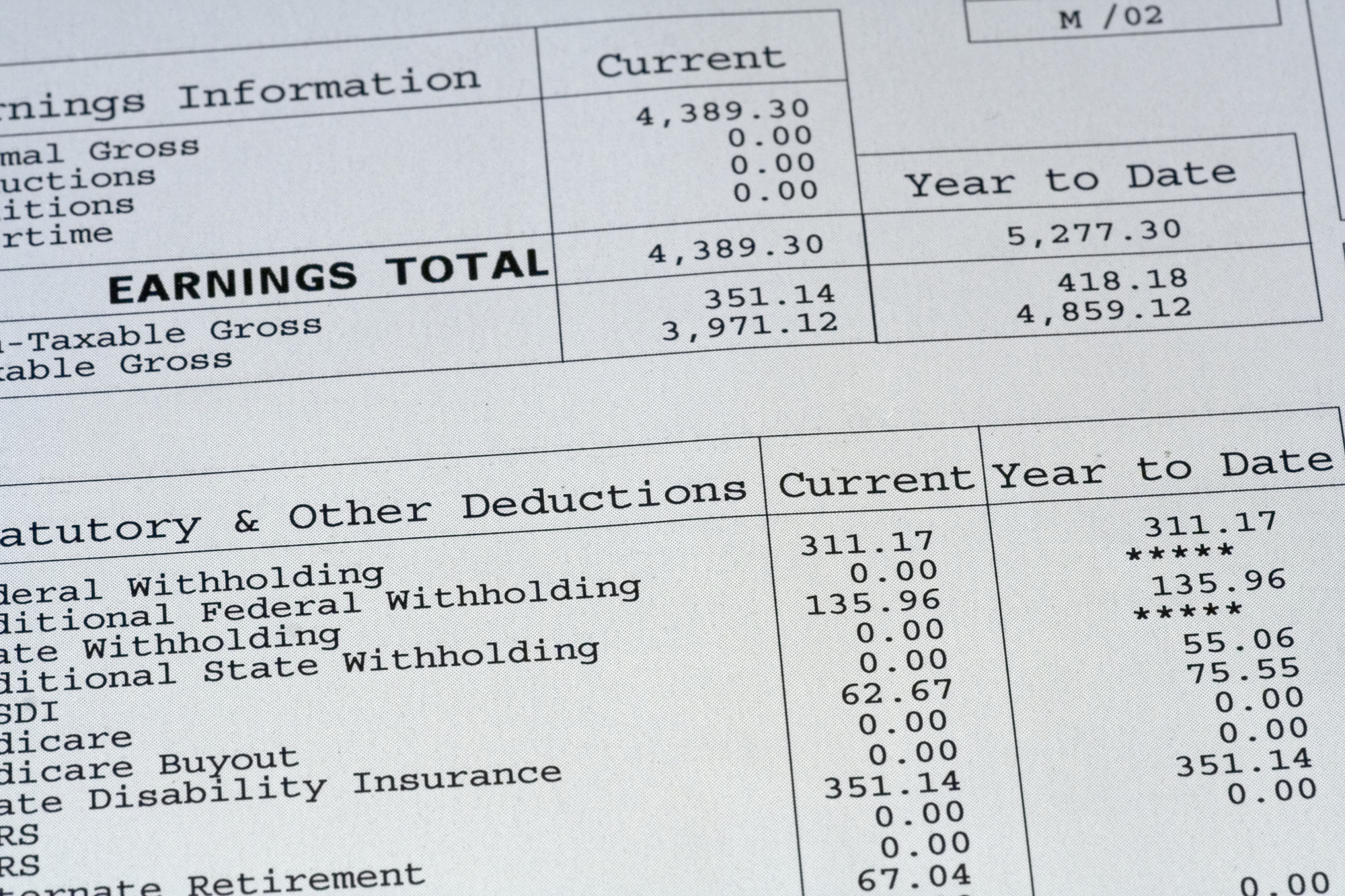

Using pay stubs to pay yourself allows you to have tangible evidence of income. This will come in handy when having to show banks your stream of income for loans, because not it will show exact numbers instead of estimates.

Generating your paystub has never been easy when using this proof of income form to print out paystubs.

Monitor and Update Financial Reports

Don’t just wait to update all financial reporting when you need it. If you make a habit to regularly update any balance sheets, expense sheets, or profit or loss statements, it will be very easy to keep track of all accounting information as well as your proof of income.

These documents will also come in handy to help determine your loan status and you may be asked to provide them.

Save Tax Returns From Previous Years

Tax returns are also capable of showing your self-employment income. Tax returns are good for nearly 7 years so having the history and record is a safe bet to show your proof of income.

Show Proof of Income

Now that you are aware of how to show proof of income when self employed, it’ll be easier to get started and not stress over it. There are plenty of tools online that can be downloaded to help keep track of business finances, and you can always talk to an accountant who can help organize your records for you.

The important thing to remember is to keep business away from personal expenses, save business receipts, and use pay stubs to pay yourself so your proof of income can be easily provided.

Check out our page for more tips on saving money, and working from home!