Budgeting is something a lot of us would like to be better at. But the thing is, successful budgeting isn’t actually that hard – you’ve just got to go about it in the right way.

So, what should you do to create a successful budget?

Well, first of all, it’s important to understand what budgeting is all about.

It’s about having full understanding and control of your finances – your income (the money you earn) and your expenditure (the money you spend).

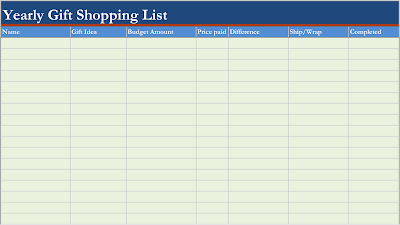

To create your budget, start with writing down absolutely everything you earn each month (that includes your wages, any benefits you receive, child maintenance payments, etc.).

Once you’ve got this written down, you need to move onto your expenditure. You should write down everything your household is spending each month. Start with your priority debts (your mortgage/rent, secured loans, utility bills, etc.), and your everyday expenses (food, transport costs, etc.).

At this stage, you shouldn’t include your non-priority debts (credit cards, unsecured loans, etc.) – as you’ll account for these later on.

Once you’re happy that you’ve written everything down, you should subtract your essential expenditure from your income – this will leave you with what’s known as your disposable income.

Your disposable incomeis basically the money you have available to pay towards your unsecured debts each month – as well as saving and spending on non-essential/luxury items.

Working with your disposable income

Now you know how much your disposable income is, you need to figure out if it is enough to cover your monthly unsecured debt repayments.

To do this, simply subtract the amount you spend on debt repayments each month from your disposable income…

If your disposable income is more than enough to cover the cost of your debts, did you know you could save yourself a lot of money in interest if you paid more towards your debts each month? So, if you’ve got spare money left over after covering the required monthly payments, you should consider overpaying your debts. Just find out if you’ll be hit with any ‘early repayment charges’ for doing this.

For advice on how to make the most of your income, you could read some of the budgeting, debt and money saving guides on this website.

If your disposable income isn’t enough to cover the cost of your unsecured debts, you should take action straight away. You need to contact your creditors and explain your situation, and it might also be a good idea to seek professional debt advice.

The right advice can help you improve your situation – you might get a few tips on how to tighten up your budget, for example, freeing up the money you need every month.